Index

Anti-Money Laundering (AML) and sanctions

Behaviour & Culture

CFO Services

Compliance

Cyber security

ESG Risk Management

Forensics & Technology

Internal Audit

IT Risk Management

Third Party Risk Management

Data Management

Data Management

As financial institutions continue to collect more data than ever before, effective data management has become essential for success. BDO emphasises that proper data management practices can lead to improved decision-making, greater operational efficiency, and increased profitability. Data and information are the raw materials for financial institutions, enabling them to identify, assess, and control important risks.

With increasing reporting obligations towards regulators, good data quality is essential. In the case of a lack of data quality, financial institutions are unable to comply with laws and regulations and make business decisions based on incorrect information. Inadequate insight into the quality of data leads to insufficient insight into an organisation's risk profile and a false sense of security. Financial institutions run the risk of not meeting the (sustainability) requirements of, for example, Basel and Solvency II. In addition, the new (Dutch) Pension Act requires pension funds to demonstrate the quality of their data. Therefore, effective data management improves data quality and security, ensuring that financial institutions comply with rules and regulations, and sensitive information is protected from unauthorised access or data breaches. In today's highly competitive market, businesses that prioritise effective data management will have a significant advantage over their competitors.

The starting point of data management is understanding the data that an organisation collects, where it is stored, and how it is used. This involves identifying all data sources, including databases, files, and applications, and determining the types of data that are collected and how they are structured. Once this information is gathered, data management professionals can develop a plan for organising and managing the data, which may include implementing data quality standards, establishing data governance policies, and selecting appropriate tools and technologies to support data management processes. Effective data management requires a comprehensive approach that takes into account the entire data lifecycle, from collection and storage to analysis and distribution.

Data quality is a critical component of effective data management. Poor data quality can lead to incorrect or incomplete analysis, which can result in inaccurate business decisions and lost opportunities. BDO emphasises that organisations that prioritise data quality will be better positioned to make informed decisions, comply with rules and regulations, control (financial) risks, reduce operational costs, and improve customer satisfaction. High-quality data enables organisations to identify patterns, trends, and insights that can inform strategic planning and optimise business processes. It can also improve data security, as accurate data is less vulnerable to errors, hacking, or other security breaches. By focusing on data quality as part of a comprehensive data management strategy, organisations can unlock the full potential of their data and gain a competitive advantage in the financial services industry.

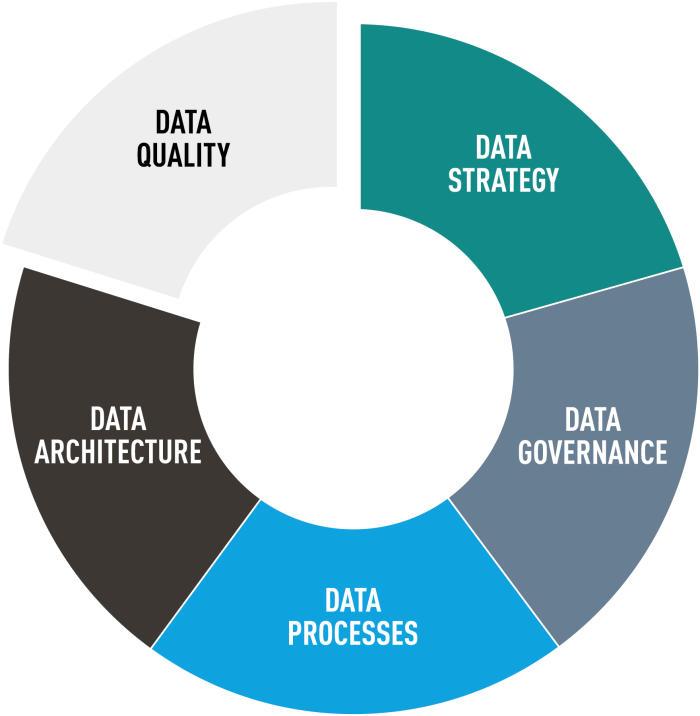

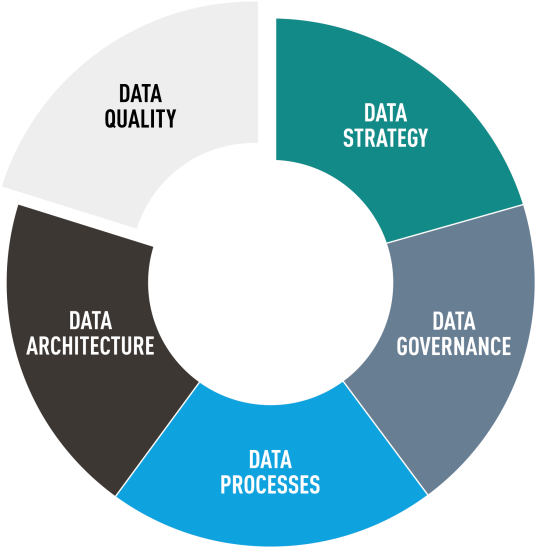

First steps of data management:

Define your data strategy and goals: Before you start managing your data, it is important to understand your goals. The goals need to be in line with the overall mission, vision, and strategy of your organisation. What do you aim to achieve by managing your data better? Are you trying to improve data quality to increase efficiency, reduce costs, or comply with (new) rules and regulations? By answering these questions, you can define your goals (including key performance indicators) and formulate your data strategy subsequently.

Establish data governance: Data governance is clearly formulating processes and procedures, including tasks, responsibilities, and authorities, so that all data quality management roles are defined. Data governance needs its own planning and control cycle for which appropriate lines of accountability have been set up. Responsibilities and mandates depend on the type of role, such as a data owner, data user, data manager, and data developer. In addition, the governance structure needs to be set up where various data roles (first line), compliance, risk management (second line), and the internal audit service (third line) come together. This also requires you to train your staff: make sure that everyone in your organisation understands the importance of data management and how to follow the established policies and procedures.

Implement data management processes: Data processes entail developing and implementing processes for data collection, storage, processing, control, and analysis. This involves using data management tools and technologies, such as databases, data warehouses, or data integration software. It includes the identification of all data sources and the assessment of this data (including the assessment of risks). These steps enable you to understand how data flows throughout your relevant value chain, including the relevant systems, interfaces, and processes. An important aspect of data management processes is the monitoring of the data (including data controls), based on the defined KPIs and KRIs. Monitoring reports, dashboards, and control measures ensure that identified risks are mitigated and the goals are obtained.

Design a compliant IT architecture: Data architecture supports the organisation in determining the current and the desired state of data management and aspects such as data warehouses, data models, ETL processes, data dictionaries, and metadata repositories. Data architecture is an essential basis for the implementation of a data (quality) management system.

Assess your data quality: Determine the quality of your data by analysing the accuracy, completeness, consistency, and timeliness of your data. This will help you identify areas that need improvement based on data profiling and data analysis. This enables you to identify outliers and perform sample checks on risk categories. Regularly review your data quality, update your data management policies and processes as needed, and ensure that your data remains accurate, complete, and secure.

Services offered by BDO

Internal audits data quality

Performing various audits in the field of data quality at pension funds and insurers Types of audits vary from policy and risk assessments to data analysis and partial observations.

Examination of data (profiling)

Performing integral data analysis on financial and non-financial data Developing a data quality tool to perform high-level integral analysis on data quality.

Specific operations: guideline 4400

In the context of the Wet Toekomst Pensioenen, we carry out a set of specifically agreed activities regarding data quality. In addition, we can perform any additional assurance engagements based on the 3000A directive.

Data insights & reporting

Developing reporting/dashboarding to report on the progress of remediation programs. Identifying risks and opportunities based on data insights to work smarter, more effectively, safer, and/or cheaper.

End user computing testing (& remediation)

Investigating the reliability of EUC solutions, including their remediation. Translating control frameworks to EUC Tool/Dashboarding.

Training and workshops

Providing workshops for clients in the field of data quality, legislation, and regulations. Providing internal training/courses in the field of data management and sector developments.

More information

Index

Anti-Money Laundering (AML) and sanctions

Behaviour & Culture

CFO Services

Compliance

Cyber security

ESG Risk Management

Forensics & Technology

Internal Audit

IT Risk Management

Third Party Risk Management

Data Management

Nathan Vastenburg

Senior Adviseur

T (0)30 633 62 74

Hans Dekker

Senior Manager IT Audit

T(0)30 633 62 87

More information

Internal audits data quality

Performing various audits in the field of data quality at pension funds and insurers Types of audits vary from policy and risk assessments to data analysis and partial observations.

Examination of data (profiling)

Performing integral data analysis on financial and non-financial data Developing a data quality tool to perform high-level integral analysis on data quality.

Specific operations: guideline 4400

In the context of the Wet Toekomst Pensioenen, we carry out a set of specifically agreed activities regarding data quality. In addition, we can perform any additional assurance engagements based on the 3000A directive.

Data insights & reporting

Developing reporting/dashboarding to report on the progress of remediation programs. Identifying risks and opportunities based on data insights to work smarter, more effectively, safer, and/or cheaper.

End user computing testing (& remediation)

Investigating the reliability of EUC solutions, including their remediation. Translating control frameworks to EUC Tool/Dashboarding.

Training and workshops

Providing workshops for clients in the field of data quality, legislation, and regulations. Providing internal training/courses in the field of data management and sector developments.

The starting point of data management is understanding the data that an organisation collects, where it is stored, and how it is used. This involves identifying all data sources, including databases, files, and applications, and determining the types of data that are collected and how they are structured. Once this information is gathered, data management professionals can develop a plan for organising and managing the data, which may include implementing data quality standards, establishing data governance policies, and selecting appropriate tools and technologies to support data management processes. Effective data management requires a comprehensive approach that takes into account the entire data lifecycle, from collection and storage to analysis and distribution.

Services we provide

First steps of data management:

Define your data strategy and goals: Before you start managing your data, it is important to understand your goals. The goals need to be in line with the overall mission, vision, and strategy of your organisation. What do you aim to achieve by managing your data better? Are you trying to improve data quality to increase efficiency, reduce costs, or comply with (new) rules and regulations? By answering these questions, you can define your goals (including key performance indicators) and formulate your data strategy subsequently.

Establish data governance: Data governance is clearly formulating processes and procedures, including tasks, responsibilities, and authorities, so that all data quality management roles are defined. Data governance needs its own planning and control cycle for which appropriate lines of accountability have been set up. Responsibilities and mandates depend on the type of role, such as a data owner, data user, data manager, and data developer. In addition, the governance structure needs to be set up where various data roles (first line), compliance, risk management (second line), and the internal audit service (third line) come together. This also requires you to train your staff: make sure that everyone in your organisation understands the importance of data management and how to follow the established policies and procedures.

Implement data management processes: Data processes entail developing and implementing processes for data collection, storage, processing, control, and analysis. This involves using data management tools and technologies, such as databases, data warehouses, or data integration software. It includes the identification of all data sources and the assessment of this data (including the assessment of risks). These steps enable you to understand how data flows throughout your relevant value chain, including the relevant systems, interfaces, and processes. An important aspect of data management processes is the monitoring of the data (including data controls), based on the defined KPIs and KRIs. Monitoring reports, dashboards, and control measures ensure that identified risks are mitigated and the goals are obtained.

Design a compliant IT architecture: Data architecture supports the organisation in determining the current and the desired state of data management and aspects such as data warehouses, data models, ETL processes, data dictionaries, and metadata repositories. Data architecture is an essential basis for the implementation of a data (quality) management system.

Assess your data quality: Determine the quality of your data by analysing the accuracy, completeness, consistency, and timeliness of your data. This will help you identify areas that need improvement based on data profiling and data analysis. This enables you to identify outliers and perform sample checks on risk categories. Regularly review your data quality, update your data management policies and processes as needed, and ensure that your data remains accurate, complete, and secure.

Data quality is a critical component of effective data management. Poor data quality can lead to incorrect or incomplete analysis, which can result in inaccurate business decisions and lost opportunities. BDO emphasises that organisations that prioritise data quality will be better positioned to make informed decisions, comply with rules and regulations, control (financial) risks, reduce operational costs, and improve customer satisfaction. High-quality data enables organisations to identify patterns, trends, and insights that can inform strategic planning and optimise business processes. It can also improve data security, as accurate data is less vulnerable to errors, hacking, or other security breaches. By focusing on data quality as part of a comprehensive data management strategy, organisations can unlock the full potential of their data and gain a competitive advantage in the financial services industry.

With increasing reporting obligations towards regulators, good data quality is essential. In the case of a lack of data quality, financial institutions are unable to comply with laws and regulations and make business decisions based on incorrect information. Inadequate insight into the quality of data leads to insufficient insight into an organisation's risk profile and a false sense of security. Financial institutions run the risk of not meeting the (sustainability) requirements of, for example, Basel and Solvency II. In addition, the new (Dutch) Pension Act requires pension funds to demonstrate the quality of their data. Therefore, effective data management improves data quality and security, ensuring that financial institutions comply with rules and regulations, and sensitive information is protected from unauthorised access or data breaches. In today's highly competitive market, businesses that prioritise effective data management will have a significant advantage over their competitors.

As financial institutions continue to collect more data than ever before, effective data management has become essential for success. BDO emphasises that proper data management practices can lead to improved decision-making, greater operational efficiency, and increased profitability. Data and information are the raw materials for financial institutions, enabling them to identify, assess, and control important risks.

Data Management